Get Covered: Free Help Applying for Medicaid or Enrolling in ACA Health Insurance through Healthcare.gov

Get Your Refund: Free Help With Tax Refunds and Credits

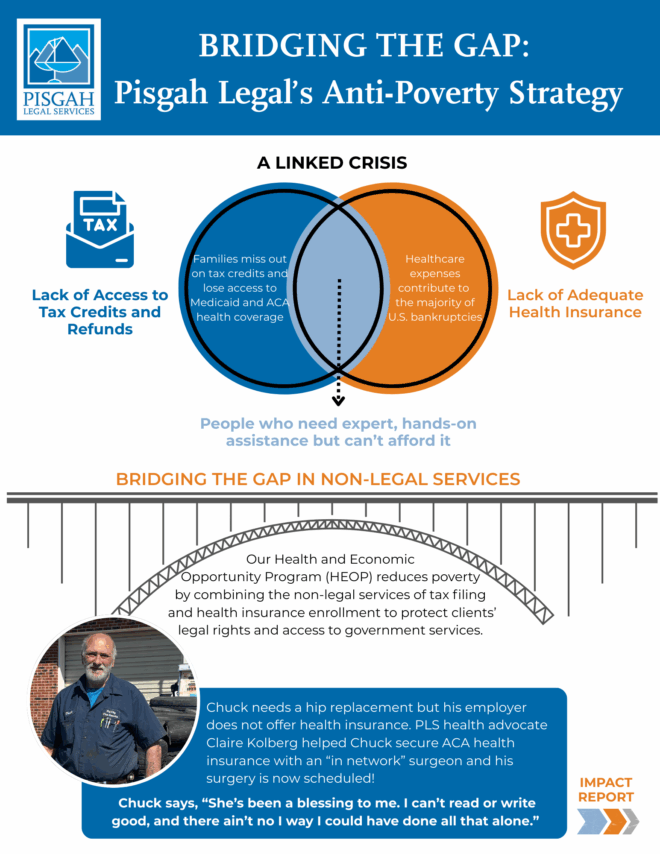

In 2021, Pisgah Legal Services launched the WNC Health and Economic Opportunity Program (HEOP), thanks to funding from Dogwood Health Trust. The program combines our Medicaid and Affordable Care Act (ACA) Navigator services with tax assistance.

The work helps people in 18 Western North Carolina counties claim tax credits that will help them access increased income and enroll in health insurance through Healthcare.gov.

Through this work, we help people make the best choices for themselves.

If you’re interested in applying for Medicaid, browsing Healthcare.gov or exploring your options if you haven’t filed taxes recently, our experienced tax preparers and healthcare navigators can help. There’s no pressure to enroll in an insurance plan or to file a tax return. If you do decide to file, we can file for you for free.

All of our services are confidential and performed by certified staff and volunteers.

We offer these services year-round, not just during open enrollment or tax season.

Call 828-210-3404 for more information.

Why health care and taxes?

When you enroll in a health insurance plan through the Healthcare.gov (the ACA Marketplace), you will likely receive a premium tax credit based on your reported income. The premium tax credit will help lower some or all of the cost of your monthly premium. You must file a tax return the year after you enroll in an ACA plan to compare your estimated income and your actual income. We can help you do that!

There are two additional tax credits available to many households with low incomes: the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC).

These tax credits could add up thousands of dollars in your tax return, but in order to access this money, you have to file taxes. If you haven’t filed before, or haven’t filed in a few years, we can help you secure tax credits and missed stimulus payments.

To learn more about the WNC Health and Economic Opportunity Program or to schedule free tax preparation or healthcare navigator services, call 828-210-3404.

Assistance is available in English and Spanish, with translation services available for other languages.

At Pisgah Legal, clients like Annie can enroll in an affordable health insurance plan and file a tax return, all one in place.

Annie works in the restaurant industry. At times she’s gone without health insurance, and owed money to the IRS after filing her taxes.

“I went six months without health insurance, and was crossing my fingers the whole time,” said Annie.

Annie came to Pisgah Legal for help and secured a health insurance plan through the ACA just in time. A few months later, she was injured and spent four days in the hospital.

“I’m just so grateful for the timing of that,” she said.

Annie decided to come back to Pisgah Legal for free tax preparation.

“This is the first time I’ve gotten money back in seven years,” Annie said. “I was elated.”

Annie said she plans to put her tax return in savings, giving her a safety net that she’s never had before.